7:25 pm ▪

6

more or less reading ▪ by

Nicolas T.

The Wall Street Journal reports that the United States is threatening to cut Chinese banks off from the dollar. This financial bombshell could greatly benefit bitcoin.

The United States Seriously Threatens the Middle Kingdom

The confrontation between the West and BRICS is set to intensify now that the US Congress has released 100 billion dollars to continue the war. Nearly 61 billion to poor Ukraine, 26 billion for Israel, and eight billion to “counter communist China”.

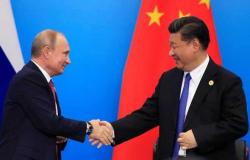

The icing on the cake, Joe Biden is also preparing to disconnect some Chinese banks from the dollar. Armed with this threat, Secretary of State Anthony Blinken made his way to Beijing this Wednesday.

“China cannot play both sides”, mr. Blinken declared on the occasion of the G7 taking place in Capri a few days earlier. “China cannot pretend to want to maintain friendly relations with European countries while fueling the biggest threat to their security since the end of the Cold War.”

“All banks that facilitate financial transactions concerning military goods to the Russian defense industrial base expose themselves to the risk of US sanctions”Treasury Secretary Janet Yellen said earlier this month.

The problem is, Russia and China have almost stopped using the dollar. About 95% of Sino-Russian trade is now settled in yuan or rubles. So much so that the only credible threat is disconnection from the SWIFT network. Or perhaps a freeze of the 775 billion dollars the Chinese central bank holds in US Treasury bonds…

However, China has its own international payment system. The CIPS facilitated transactions worth the equivalent of 17 trillion dollars in 2023.

And while 85% of Chinese international transactions involved the dollar in 2010, it’s only 42% today:

The Empire in Overdrive

The United States is ramping up sanctions. Venezuela suffered from them again a few days ago, and Pakistan could well be next on the list. Washington brandished its threats immediately after the recent three-day visit by the Iranian president to Islamabad.

The gas pipeline project has angered the Americans who are determined to prevent Iranian gas from reaching the Chinese industrial giant at all costs.

Let us not forget that Syria was destabilized to prevent the gas linkage between Iran and Europe. Iran does indeed have the second-largest gas reserves in the world.

The geographical position of Syria makes it crucial for any gas pipeline connecting Europe to the Middle East. Unfortunately for the Syrians, favoring the Iranian tube over Qatar’s has led to their downfall.

[Iran and Qatar indeed both draw from the same North Dome / South Pars gas field across their maritime border.]

The Shiite alliance had long displayed the ambition of building a gas pipeline to quench Europe’s thirst. This project called “Friendship Pipeline” was assigned to the Swiss company Elektrizitäts-gesellschaft Laufenburg which was forced to withdraw due to American sanctions.

It is no coincidence that “the free Syrian army” was created a few months only after the signing of the framework agreement between Iran, Iraq, and Syria. Not to mention ISIS emerging simultaneously on the Iraqi side…

Geopolitics is inseparable from the map of energy resources. It’s about controlling energy resources and the currency in which they are purchased. Yet, the Persians refuse to sell their oil and gas exports in dollars.

Hence the embargo that the United States has imposed on them for several decades. It always comes back to the petrodollar.

Chaos and Bitcoin

How much longer can the United States afford to sanction all nations that refuse to align with their imperialist foreign policy?

BRICS now forms an alliance too imposing to be intimidated by force. The alliance holds almost 40% of the world’s oil reserves, and with Venezuela, that figure is nearly 57%. It’s even close to 60% when it comes to gas.

The hospitality of the West towards emerging countries is very concerning. We are headed towards a rupture of trade relations, or even a world war if the United States does not agree to give up their exorbitant privilege (petrodollar).

More than 20% of oil exports are now sold in currencies other than the dollar. BRICS has no intention of backing down.

Unfortunately, the Americans refuse to come to terms with this. The risk of a breakdown of trade relations.

Nothing would be more bullish for bitcoin. For three reasons. The first is that bitcoin transactions are unstoppable, unlike those on the SWIFT network. Bitcoin and the Lightning Network form a very valuable global payment network in the event of fragmentation of payment systems.

Secondly, if Beijing also gets its foreign exchange reserves “frozen”, more and more nations will consider bitcoin as an international reserve currency. The fact that central banks are buying gold like there’s no tomorrow is a very good sign.

Finally, the widespread inflation that deglobalization would cause would quickly draw attention back to bitcoin and its absolutely finite monetary supply.

It’s no coincidence that bitcoin appreciates as geopolitical tensions increase. Don’t miss our article: Bitcoin Should Replace the Dollar.

Maximize your Cointribune experience with our ‘Read to Earn’ program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Click here to join ‘Read to Earn’ and turn your passion for crypto into rewards!

Nicolas T.

Bitcoin, geopolitical, economic and energy journalist.